Successfully servicing wealth management clients requires an in-depth understanding of their needs with respect to return expectations but also with respect to their risk perception. The process of determining the client’s risk tolerance is a key component of successfully advising clients. Best practice in determining the client’s risk tolerance is using a psychometric questionnaire. The risk profiling spider model assesses the client’s risk tolerance along the five dimensions, i) expectation bias, ii) anchoring, iii) loss frequency, iv) loss magnitude, and v) reactivity. The process of risk profiling can be turned into a competitive advantage by advising on solutions that match the client’s risk profiling spider.

Wealth management is about investing with the aim to generate a financial return that exceeds the risk-free rate. To achieve that goal, risks must be taken. It is therefore important to understand the risks taken, and even beforehand, the ability and willingness of the client to take these risks. Client risk assessment or risk profiling is about understanding the client’s aversion towards risks to be taken, his risk tolerance. Risk profiling also serves in fulfilling the fiduciary duty of knowing the client. In addition, risk assessment approaches are used to guide clients towards specific strategic asset allocation or benchmark-oriented investment solutions. Risk profiling is also used in a structured advisory process to help clients avoid biased decisions or irrational behavior.

UNDERSTANDING RISK

The ISO 22222 personal financial planning standard defines the

risk tolerance as the extent to which a client is willing to risk experiencing a less favorable financial outcome in the pursuit of a more favorable financial outcome.

The Markets in Financial Instruments Directive 2004/39/EC, known as MiFID, requires the investment advisor to

- assess the financial knowledge and experience,

- determine the financial situation and loss capacity, and

- understand the client’s goals and expectations

to ensure that recommendations are suitable for the respective client, including that the client’s risk parameters are considered.

DIFFERENT DIMENSIONS OF RISK TOLERANCE

It is important to distinguish between

- risk requirements,

- risk capacity, and

- risk tolerance.

Risk requirements describe the risks a client must be willing to accept in order to be able to achieve his objectives. Under MiFID, this is achieved through understanding the client’s investment objectives.

The risk capacity defines the amount of wealth the client can lose before running into bankruptcy or being with certainty unable to meets his objectives. Usually, the risk capacity can be determined analytically and expressed as a dollar amount.

The risk tolerance, or attitude towards risk, describes the behavioral perception of risk by the client. A client may well be able to lose a given amount of wealth without adverse impact, but feel very unease, to say the least, and lose all trust in his wealth manager when it happens.

ASSESSING THE RISK TOLERANCE

There exist three main techniques for assessing the risk tolerance of a client.

- Observing actual behavior – The soundest assessment is achieved when observing the client’s behavior in actual financial turmoil situations. Unfortunately, very often, only a limited amount of data is available or made available by the client.

- Laboratory tests – Experiments are conducted where the client must decide upfront how to invest or de-invest based on given information.

- Questionnaires – The client is required to answer several questions related to his person, his thinking about investing, and his experience with financial markets.

Questionnaires are the most common approach used to determine the client’s risk tolerance. Within questionnaires, three approaches, listed in increasing order of their effectiveness, are common.

- Investment strategy selection questionnaires

- Scoring based questionnaire

- Psychometric test

Research has shown that psychometric questionnaires provide the most relevant risk tolerance assessment.

In addition, demographic information of the client plays a significant role in his risk tolerance. For example, the age of a client is negatively correlated with his risk tolerance. Women are more risk averse than men. Education as well as income and wealth have a positive impact on risk taking preferences. And, single people are less risk averse than married people.

RISK PROFILING USING THE SPIDER MODEL

The risk tolerance of a client is an attitude that is made up of a balance of different properties. Rather than try to combine these properties into one risk tolerance score, as it is common, a multi-dimensional approach allows a more appropriate representation of a client’s attitude. We, at innovate.d, have developed the spider model to risk profiling which consists of five dimensions, the exposure to each dimension being determined by a psychometric test.

- The expectation bias describes how the client’s preference relates towards the expected return of an investment. For example, does a client prefer to lose $1’000 for sure or lose $2’500 with a probability of 50%?

- The anchoring dimension describes to what extend the client’s risk tolerance is determined by recent market events.

- The loss frequency dimension measures to what degree the frequency of losses plays a role for the client. Does the client prefer to lose $10’000 once versus losing $1’000 ten times in a row?

- The loss magnitude dimension describes how important the amount of a loss, for example, from a market crash, is to the client. It defines the need for diversification along different investment risk dimensions.

- The reactivity dimension describes how quickly the client will react to market move¬ments. This is tightly linked to path dependence.

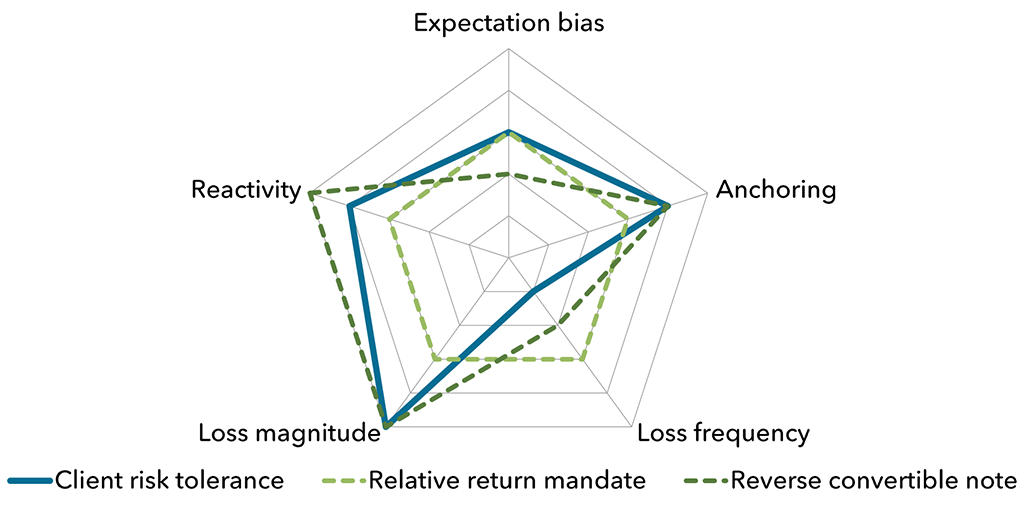

The risk tolerance spider, as shown in Exhibit 1, determines the universe of acceptable risk properties. It illustrates the risk tolerance of a client towards each of the five dimensions. The closer the reading of a dimension is towards the center of the spider, the lower the client’s sensitivity towards that dimension. For example, the client depicted in Exhibit 1 has a very high sensitivity towards large losses (magnitude dimension) but is not very sensitive to frequent losses. A client matching this kind of risk tolerance profile is more sensitive to market crashes than to poor performing products.

TURNING RISK PROFILING INTO A COMPETITIVE ADVANTAGE

In a benchmarking study on how private banks in Switzerland advertise their risk profiling capabilities, more than 40% of the private banks referencing risk profiling on their internet site do so in the context of discretionary mandates geared toward selecting strategic asset allocation-oriented solutions. Only 10% of all studied private banks illustrate the role of risk profiling as part of their advisory process.

When integrating risk profiling in the solution development process, the advisor can show to the client his capability of not only defining a solution that satisfies the client’s needs with respect to return expectation but also with respect to risk. Talking openly about risk with the client allows to gain trust as the client gets the feeling that the advisor has a deep understanding of his perception of risk. The risk discussion becomes an integral part of advising clients and not a necessary evil.

The risk profiling spider model can be used to show to the client how a proposed solution aligns with his risk tolerance and discuss potential deviations. Exhibit 1 shows the risk profile of two solutions, a balanced relative return discretionary mandate and a reverse convertible structured products note.

Risk profiling and the associated risk spider tool allows restraining the client’s fear associated with investment risk. It allows, in an objective way, to understand and actively manage the client’s perception of risk.

LESSONS LEARNED

- There exist three dimensions of client risk to be understood, that is, i) risk requirements, ii) risk capacity, and iii) risk tolerance.

- The most effective way of determining the risk tolerance is through a psychometric text.

- Risk tolerance has five major dimensions: i) expectation bias, ii) anchoring, iii) loss frequency, iv) loss magnitude, and v) reactivity. They can be graphically represented using the risk tolerance spider.

- The spider model supports gaining trust with the client by showing that the advisor actively manages the client’s understanding of risk.

- The spider model allows, in an easy and graphical way, to determine the risk tolerance adequacy of different investment products.