Most traditional pension funds operate under an administrator type of operating model. Their focus is on execution rather than service providing. Pension funds aiming at being contemporary should adjust their operating model to that of a service provider. The primary focus should be on the beneficiaries, implementing a service oriented operating model aiming for efficiency and high-quality standard.

From a traditional perspective, the role of a pension fund is to collect the premia from their members, mange the funds received according to the pension fund’s plan and investment targets, including insuring the risks of disability and death, and pay annuities to retired members. An administrator type of operating model is implemented, focusing on actuarial and investment aspects. Services provided to beneficiaries, like for example, advising on options available at retirement, are seen as a necessary burden, rather than value adding. Going forward, pension funds should increasingly focus on their beneficiaries and move towards a service provider oriented operating model in addition to offering advantageous pension plan conditions.

OPERATING MODEL

The operating model defines how a pension fund implements its strategy by decomposing it into

- a business model, focusing on client segmentation, interaction with clients, and on services and products offered, and

- a business architecture, describing the functions, organizational structure, and technology platform required to implement the business model.

The operating model framework also provides a platform for aligning and communicating change.

BUSINESS MODEL

The business model contains three components, that is,

- a client segmentation,

- products and services offered, and

- communication channels.

CLIENT SEGMENTATION

In the administrator type operating model, the pension fund’s sole clients are the beneficiaries, active or retired. The most commonly observed client segmentation uses some sort of alphabetic decomposition. When focusing on providing high quality services efficiently, a segmentation based on the client needs is more appropriate. A possible client segmentation would be clustering

- active beneficiaries without special needs,

- active and retired beneficiaries subscribing to special products and services,

- retired beneficiaries only receiving pension payments, and

- beneficiaries with special conditions, like disability, that need case by case handling.

This segmentation allows grouping skills as well as processes needed for high quality and efficient client servicing.

When moving to a service provider business model, the definition of client segmentation needs to be extended to include the employer. Indeed, both from a strategic as well as operational perspective, the employer, sponsoring the pension fund, is key to its operations. Services provided, and interfaces should be formalized and streamlined.

PRODUCTS AND SERVICES

Services related to beneficiaries without special needs encompass joining, leaving, contributions, and pension payments. They distinguish themselves by being producible in a fully automated way.

Special services, like home ownership funding support or early retirement, require a manual intervention. The aim should be to provide process support to deliver these services assuring the same quality of service is provided every time.

Services related to a special condition of a beneficiary, like invalidity, usually require specific skills and expertise, like legal know-how, to be handled. These services are best delivered by human experts rather than systems or processes to assure the required flexibility and quality of service.

COMMUNICATION CHANNELS

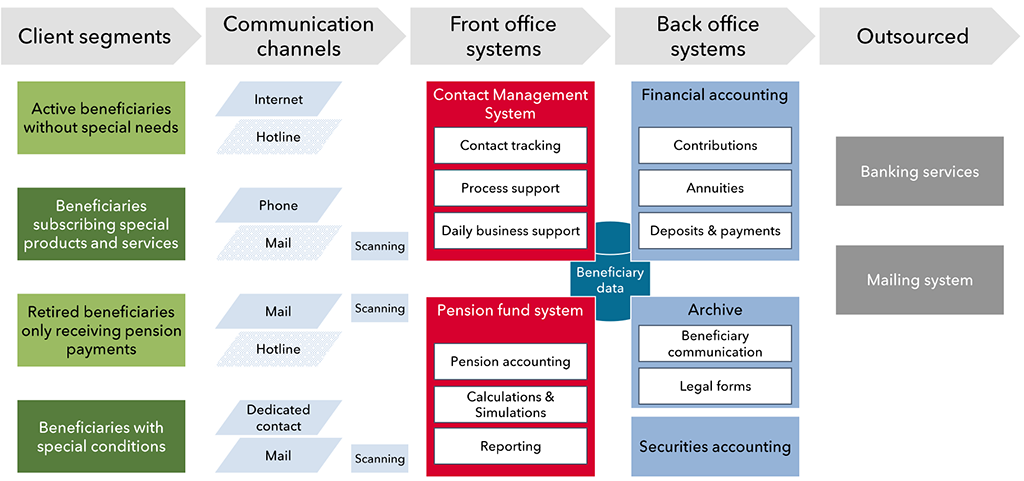

Communication channels need to be adapted to the services provided. Exhibit 1 shows a possible technology architecture supporting the different beneficiary client segments suggested. Especially for large-sized pension funds, it is imperative to automate the communication channels as much as possible, for example, by introducing a self-service kiosk.

BUSINESS ARCHITECTURE

The business architecture takes an internal view to the operations of a pension fund. It can be decomposed into four components.

FUNCTIONS AND PROCESSES

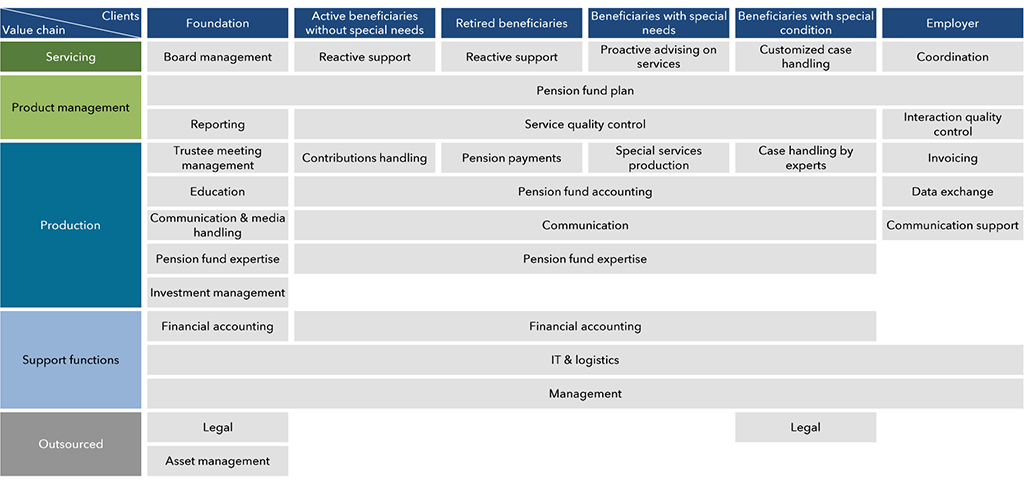

The functional landscape shown in Exhibit 2 illustrates the different functions a pension fund needs to perform and maps them onto the client segmentation. This shows how each function supports the service provider operating model. Indeed, functions only exist to satisfy a need and provide a service to one or more client segments.

OUTSOURCING

The outsourcing dimension of the business architecture needs to answer the questions related to which functions are part of the core competencies of a pension fund and which can and should be outsourced. The most common functions to address in this context are

- asset management,

- pension fund expertise,

- legal counseling,

- information technology, and

- communication production.

Whether these functions should be outsourced depends on the specificities of a given pension fund, services that can be provided by the associated employer, and its strategic positioning.

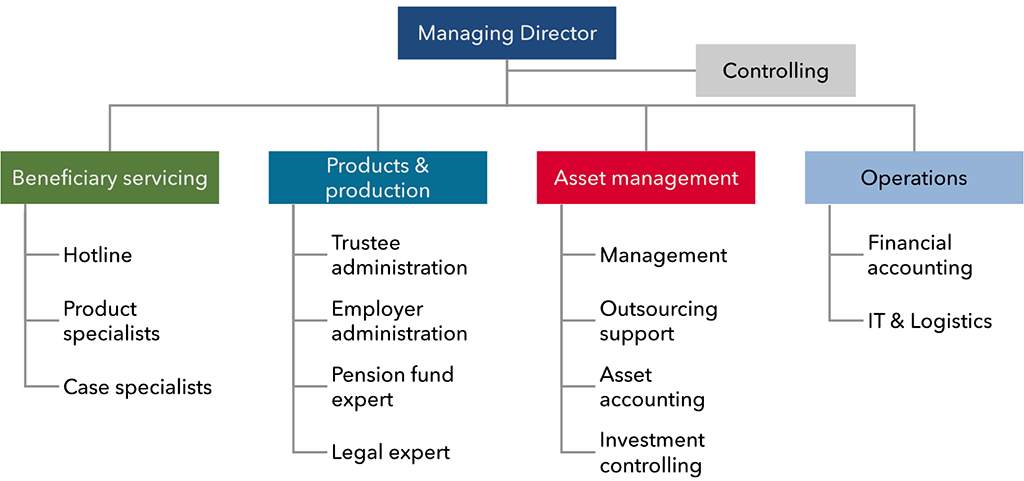

ORGANIZATION

Not only the functional landscape implemented by the pension fund should be focusing on service providing, but also the organizational structure and associated governance model should support a decomposition of the functional architecture along the value chain, that is, client servicing, product management including asset management, and operations. Exhibit 3 illustrates a possible organizational structure.

TECHNOLOGY

The last but not least component of the business architecture is the technology dimension. Introducing a client relationship management system will allow focusing on client servicing. In addition, services that can be best executed directly by the beneficiary without requiring pension fund employee resources or skills should be migrated to an internet kiosk.

LESSONS LEARNED

- Start by developing a target operating model putting the focus on the concept of service providing.

- Define the clients and segment them so that they can be served in an efficient but also effective way and adapt the communication mechanisms implemented accordingly.

- A pension fund does not need to execute every function in-house. Use outsourcing wisely.

Successfully moving toward a service-oriented organization requires change. Support the change by adopting the organizational structure and especially the governance structure to focus on service providing rather than administration.