Offering high service quality requires wealth and asset managers to communicate in a consistent way about their investment products, especially with respect to market forecasts and realized performance. Using the macroeconomic baseline scenario (MEBS) approach allows broad consistency among products without scarifying well-defined performance ownership. The MEBS approach copes in a quantitative way with a one-year forecasting horizon and offers themes and trends forecasts for a longer-term horizon. Investment professionals, research analysts, as well as sales and marketing collaborators can take advantage of a consistent baseline MEBS. In addition to improving quality and transparency, the proposed approach allows generating added value for the wealth and asset managers through efficiency and effectiveness gains.

One of the major challenges faced by wealth and asset managers is communicating consistent market expectations throughout the product portfolio on one side and assuring clear performance ownership on the other side. This challenge can be addressed by defining a common macroeconomic view on the markets that is valid as the baseline scenario for all investment products manufactured and for all client communication. The macroeconomic baseline scenario (MEBS) is the main anchoring point around which the wealth and asset managers generate investment performance. Potential deviations found in individual investment products are from the baseline scenario rather than from the current market environment. For example, the MEBS may forecast that interest rates will raise over the next 12 months. In a trading oriented product with a forecasting horizon of less than one month, the responsible portfolio manager may well have a long duration positions explained by his short-term view on interest rates without doubting the long-term oriented MEBS.

The MEBS should be used as the basis for all market forecasting activities, whether top-down or bottom-up. It guarantees forecasting consistency around the different asset classes (fixed income, equity, real estate, etc.) and investment strategies (tactical asset allocation, trend following, etc.). It also allows for a fixed income portfolio manager in New York to rely on the same MEBS as a marketing expert in Frankfurt selling a balanced mandate.

AN OPERATING MODEL

The set-up requried to successfully produce MEBSs can be described using the operating model approach. Four major dimensions need to be considered:

- Product description – what is understood by a MEBS

- Clients – who is relying on the MEBS

- Processes – how is the MEBS created and how is its quality assured

- People – who is involved and as such responsible for the definition of the MEBS and its performance

PRODUCT DESCRIPTION

A successful MEBS contains two components:

- Themes and trends – A long-term, that is three to five years, scenario defined by a set of themes and trends that are believed to become relevant in the future.

- One year forecasts – One calendar year, point forecasts relative to the consensus market expectations. Forecasts for growth, inflation, and jobless claim form the core of these forecasts. In addition to the point forecasts, a confidence in the forecast, the key drivers behind the forecast, and a set of arguments is stated.

CLIENTS

There exist three categories of clients for MEBSs:

- Research analysts providing bottom-up or top-down input for different investment products.

- Investment professionals responsible for the investment performance of individual products.

- Marketing and sales professionals communicating with clients and potential clients about investment products, their positioning, and their performance.

PROCESS

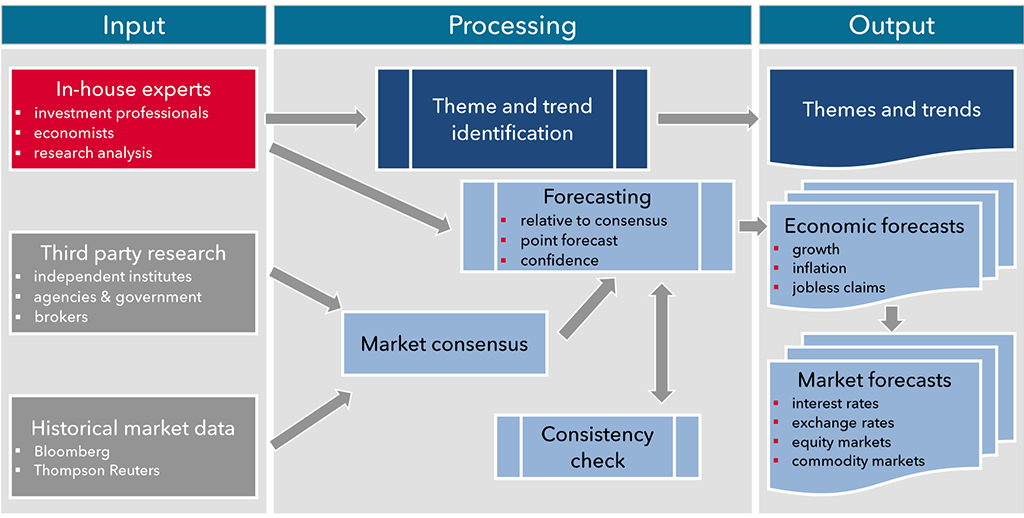

An overview of a sound MEBS process is shown in Exhibit 1. It relies on multiple independent sources of input.

INPUT SOURCES

To assure that all angles are covered, input from three different types of sources should be used:

- In-house experts and people responsible for the investment performance of individual products. They ensure a buy-in from the end-clients and allow using the unique capabilities of the wealth or asset manager.

- Third party research from independent research institutes (IFO, etc.), agencies and governments (ECB, FED, etc.), as well as brokers (UBS, Nomura, Goldman Sachs, etc.). These sources allow gaining different perspectives and ensure that the right questions are asked.

- Historical market data provided by data providers like Blooomberg, Thompson Reuters, etc. Using historical data allows identifying trends and cross-check forecasts for historical consistency.

THEMES AND TRENDS

The goal is to identify major themes and trends that are expected to become relevant for financial markets in the future. A possible tree stage process is:

- identify potential themes through a methodological screening process.

- cross-check the relevance of these themes within the industry.

- prioritize the selected themes for their relevance.

This process should encourage out of the box thinking. External experts should be considered.

ONE YEAR FORECASTS

On the one-year horizon, the forecasts should include the three most important macro-economic indicators, that is, growth, inflation, and jobless claims. Each forecast should be comprised of

- a quantitative point forecast for a one calendar year time horizon as well as for the first half of that calendar year,

- a confidence in the forecast,

- the key drivers behind the forecast, and

- qualitative arguments supporting the forecast.

The four major regions, Europe, United States, Japan, and Asia ex. Japan should be considered. Depending on the resources available and the granularity at which the forecasts are used, more regions or a finer decomposition of the regions may be implemented. But bear in mind that the focus should be on quality rather than on quantity.

Forecasts, as well as themes and trends, should be revised on a quarterly basis and controlled at least on a monthly basis. The quality of the forecasts should be measured relative to the market consensus rather than an abstract zero-sine.

PEOPLE

Investment management is a people’s business and so is developing a high quality MEBS. Team members should be selected according to three criteria

- macro-economic knowledge and education,

- proven macro-economic forecasting skills, and

- interests and ability to work in a team environment defining the macroeconomic baseline scenario.

It is important to avoid conflict of interests when building the team. The composition should be a reasonable mix of junior and senior investment professionals. The team should be chaired by a senior, but neutral, officer assuring communication and acceptance of the output produced throughout the organization. Ideally, the team is based in one location to foster interaction. To guarantee that the output produced is integrated seamlessly into the different investment products and services, the team members should be investment managers working part-time in defining the macroeconomic baseline scenario and not be full-time economists.

LESSONS LEARNED

There exists a need for a single MEBS:

- Investment products relying partially or completely on a top-down investment process need a coherent view on the markets

- Equity as well as credit analysts require input about the future of the economy as input to their models

- Sales and marketing can improve their communication and selling capabilities by speaking one single voice

Having a single MEBS in place, addition to the three needs already mentioned, adds value for the wealth manager around three dimensions:

- Allows avoiding redundancies by developing only one MEBS within the company and not different MEBS for different locations and/or products

- Brings together the brightest people guaranteeing the highest possible quality

- Allows differentiating from competitors by having an innovative, structured, and consistent setup