Recent discussions about the future of private banks in Switzerland have led different participants quoting asset management as being the magic weapon to replace lost revenues from traditional private banking offerings due to margin pressures and regulations. Such a move can only be successful if the specificities of the asset management business model are well understood and its required skill set developed. Asset management strongly focuses on investment performance and transparency, capabilities that are distinct from those predominant in private banking.

In an industry driven by private banking, asset management has for a long time been a stepchild for Swiss banks. Although revenues and cost/income ratios are decent, asset managers servicing institutional clients were rarely able to compete on a profitability basis with wealth managers for private clients. There are two main reasons for this:

- private clients are less price sensitive than are institutional clients, and

- the focus for private clients is more on service quality than on investment performance.

These reasons were in the past magnified by the fact that a large portion of the private client assets held at Swiss banks were so-called “tax neutral assets”. Private banks had mainly to outperform with their investment solutions the client’s domestic tax rate. Although this business model may be seen as unethical, from a Swiss legal perspective, it was sound.

CHANGE HAPPENS

Unfortunately, or fortunately, depending on your point of view, with the advert of globalization, domestic and international legislation got much more intertwined. This resulted in various countries, lead by the United States of America, imposing their national legislation to their citizens, wherever they are investing their assets. As a consequence, significant private banking assets booked in Switzerland are at risk. Some sources state that up to ¼ of all off-shore funds from surrounding countries will be withdrawn. In addition, a forced move to a taxed money business model makes Swiss private banks look for new sources of revenues and assets.

ASSET MANAGEMENT AS AN ALTERNATIVE

One possible alternative to compensate for eroding margins in private banking and to take advantage of economies of scale is moving into asset management. This trend is currently discussed within the banking industry in Switzerland, for example in an interview with Vontobel’s CEO Zeno Staub by the “Handelszeitung” or in a review by the Swiss Bankers Association’s president Patrick Odier, as reported by the “Neue Zürcher Zeitung”. This is a clear change in trend from recent years where private banks separated their asset management units, for example Credit Suisse selling their non-Swiss asset management to Aberdeen Asset Management or Bank Julius Bär, transferring theirs into the newly created Swiss & Global Asset Management company.

ASSET MANAGEMENT AS A BUSINESS MODEL

To ensure a common understanding, let me define what I understand in this insight by asset management. In its most general form, asset management stands for the business of managing client assets on a discretionary basis. In Europe and notably in Switzerland, a narrower definition of asset management is common.

Asset management is the business of managing money on discretionary basis for institutional clients, notably pension funds, insurance companies, trusts, and corporate treasuries, as well as managing mutual funds sold to private and/or institutional investors.

Although not explicit from this definition, there exist many significant differences between managing assets for private clients, as done within private banking, and for institutional clients or funds, as performed by asset managers. Exhibit 1 shows the most important differences.

| Characteristic | Asset management | Private banking |

|---|---|---|

| Assets per client / product | > 10 mio., sometimes > 100 mio. | Starting at 0.5 mio. |

| Gross margin | 10bp – 30bp | 60bp – 120bp |

| Cost / income ratio | 50% – 60% | 60% – 80% |

| Clients / portfolio manager (pm) | 1 – 2 pm per fund 10 – 50 clients per pm |

20 – 500 clients per pm, depending on customization |

| Relevance of product performance | Key (alpha) league tables (funds) |

Average Absolut performance in focus |

| Benchmark driven | Yes | Not explicitly |

| Transparency | High, consultant driven | Medium to low, trust-based approach |

| Regulatory environment | Strict but simple regulation | Partially self-regulated Increased regulation |

| Tax environment | Partially tax exempt | Complex, if taxed money |

| Competition | Global, intense | Not very intense because of trust factors |

| Advisory component | Often taken care of by consultants | Important |

A SWOT ANALYSIS

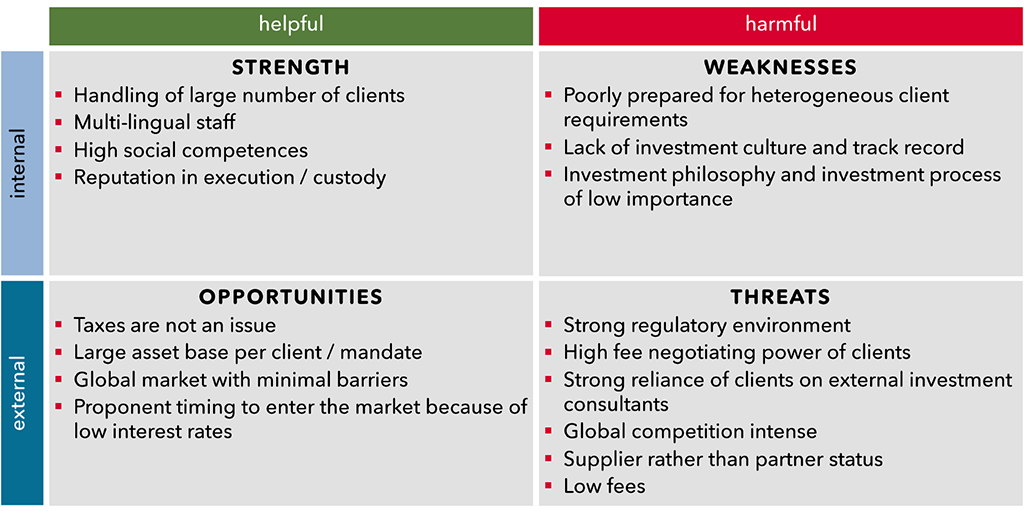

To better understand why and how asset management could be an option for private banks to adapt their business model, let me have a look at a SWOT (strength-weaknesses-opportunities-threats) analysis of entering the asset management business from a typical private bank’s point of view as shown in Exhibit 2.

As can be seen, there exist a decent number of opportunities that speak in favor of such an undertaking. But there also exist significant threats that need to be overcome. The most notable challenge faced is to prove that a Swiss private bank can compete in an international and transparent environment where investment performance plays a central role, a virtue that has somewhat been neglected in the past.

POSSIBLE STRATEGIES

As in any crowded business environment, only a well formulated and executed strategy building on the following five pillars leads to success:

- A distinct value proposition, expressed through a well-formulated investment philosophy and a well-documented investment process.

- A tailored value chain, focusing on streamlined, transparent, and scalable execution.

- Trade-offs different from rivals with respect to which and how assets are managed.

- A fit across the value chain, allowing to leverage capabilities across clients and solutions / products.

- Continuity over time, expressed by track records allowing clients to identify with the offered investment solutions.

There exist three broad strategies that can be followed:

FOCUSING ON INSTITUTIONAL CLIENTS

The most common strategy implemented by asset managers, especially global asset managers that operate independently of any captive channel, is focusing on institutional clients. Institutional clients define a very concise framework, including benchmark selection, in which the asset manager must exhibit its investment capabilities. The added value comes through the uniqueness of the investment philosophy and associated track record combined with a seamless cost-efficient execution. The main challenge is to deliver on the agreed upon investment performance under stringent client defined restrictions. In addition, asset under management size is key, particularly when competing in actively managed core asset classes.

BECOMING A FUND PROVIDER

A second possible strategy is to become a fund provider. The skills and capabilities required are like those focusing on institutional clients. But there are two notable differences:

- The primary focus is on offering the “right” funds, which means, staying ahead of the curve on the next successful investment themes and investor needs. A robust pipeline with frequent new and innovative products is important. Investment performance remains relevant as only funds on the top of the league table get sold but is by no means sufficient to be successful.

- Client servicing and customization are of lesser importance, especially as the counterparty of the asset manager is not the actual client buying the fund, but an intermediary.

Due to the small number of funds per portfolio manager, sophisticated straight through processing setups are of lesser importance.

Alternatively, if a strong distribution channel is available, a possible strategy is to focus on providing solution funds that meet any of the following client needs:

- cash flow generation,

- capital preservation, or

- capital appreciation and diversification.

DISSEMINATE STRENGTH AS A NICHE PLAYER

A third possible approach is to implement a niche player strategy and focus on a well-defined segment of the market. For example, Fisch Asset Management, focusing predominantly on convertible bonds, implements such a strategy. Specialized products, mainly those exhibiting

- low correlations to fixed income and equity markets and / or

- delivering above average yield to compensate for the low interest rate environment

are beneficial as basis for niche strategies. The main advantage of a niche strategy is that the asset manager needs only focus its capabilities on a narrow client/product/market segment. On the downside, there is little opportunity for diversification.

Whatever strategy is chosen, implementing an operating model that finds the right balance between effectiveness (doing the right thing) and efficiency (doing the things right), combined with flexibility is important for success.

LESSONS LEARNED

Transforming or extending a private bank into a successful asset manager is possible but will require a lot of hard work and a shift of mindset of the employees towards an investment performance driven culture.

- Asset management focuses primarily on investment performance in a global and transparent environment whereas private banks are used to distinguish themselves through their service capabilities and being discreet.

- Swiss private banks possess significant assets that can help them move into the asset management space.

- Asset management requires economies of scale with respect to assets under management and clients served to be profitable.

- In addition to offering a unique investment philosophy, investment performance is key for surviving and thriving in the competitive asset management environment.