A key challenge faced when developing new or enhancing existing wealth management solutions is ensuring that all aspects of the value chain are covered, from defining the targeted customer segments, though providing a value proposition, to ensuring the right capabilities are available. The Wealth Management Canvas provides a holistic framework for designing, discussing, validating, and documenting successful wealth management solutions.

When designing new or enhancing existing wealth management solutions, you can make numerous mistakes!

- You may identify the wrong customer segments.

- You may fail to meet actual customer needs, alleviate felt pains, deliver upon sought-after gains.

- You may be unable to build a trusted relationship with the targeted customers.

- Your solution may not differentiate itself from that of your competitors in a way that would convince customers to switch to your offering.

- Your price may not be aligned with the value delivered, your solution may be too expensive, or too cheap.

- You may fail to deliver upon the promises made with your solution, not delivering the bespoke value.

- Your offering may be understood incorrectly or not at all by different customer segments.

The Wealth Management Canvas (WMC) helps overcome these, and many other obstacles. It provides a common language for designing, discussing, validating, and documenting wealth management solutions.

THE WEALTH MANAGEMENT CANVAS

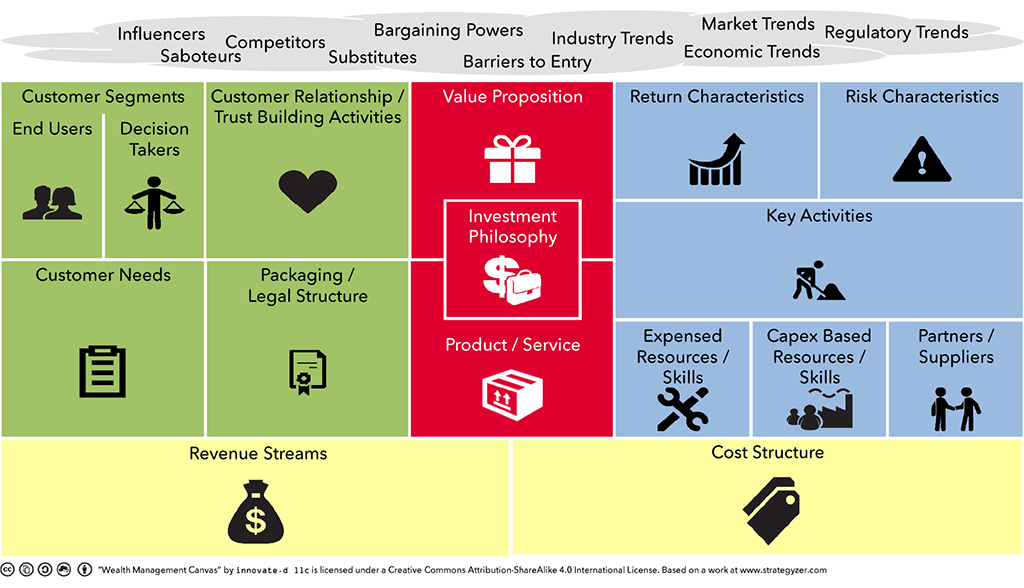

The wealth management canvas, shown in Exhibit 1, provides a holistic framework for designing, understanding, and communicating about wealth management solutions. It is based on the successful Business Model Canvas from Osterwalder & Pigneur, tailored to the wealth management industry. It is composed of four components, each component comprising of multiple elements:

- The customer component (green),

- the offerings component (red),

- the production component (blue), and

- the financials component (yellow).

In addition, it is surrounded by a grey cloud, representing the external environment.

The elements of the WMC are defined in an iterative, rather than linear, way. Challenges faced in one element of the WMC are solved by adjusting elements other areas. For example, if the designed offering does not satisfy the needs of the identified customer segment, either the offering may be changed, or the customer segment adjusted.

CUSTOMER COMPONENT

At the core of the customer component sits the customer segments, both end-users and decision-takers. It defines which customers are targeted by the offering. The WMC distinguishes between end-users, that is, customers who actually take advantage of the offering, and decision-takers, that is, those who decide whether or not to buy the offering. Many wealth management solutions fail because they assume that the end-use is also the decision-taker. Associated with the customer segments are the customer needs that the customers want to have satisfied.

To reach the targeted customer segments, the WMC defines how the customer relationship is managed. This means understanding how a trust relationship with the customers is build and maintained.

The fourth and last element of the customer component defines how the offering is delivered to the customer, that is, what packaging and legal structure will be used.

OFFERINGS COMPONENT

The offerings component describes the offering proposed to satisfy the identified customer needs. It is composed of three elements:

- The value proposition element describes how the offering will add value for the customer by satisfying one or more of the identified customer needs.

- The product / service element defines what the customer will get.

- The investment philosophy element defines the fundamental beliefs that are at the core of delivering the offering. It links the value proposition to the product / service element.

PRODUCTION COMPONENT

Once the offering has been defined, the production component describes how the promises made will be satisfied (by defining the return and risk characteristics) and which key activities (functions, processes) need to be performed. Expensed resources and skills (like personnel, etc.), investments (like intellectual property, technology, etc.), and external partners and suppliers round up the definition of the production component.

FINANCIALS COMPONENT

The fourth component of the WMC focuses on financials. Unless the intention is to compete purely on price, the financials component should be completed last.

- The revenue streams need to be described and related to the customers’ perception of value delivered. The focus should be on the model behind the revenue streams rather than the actual figures.

- The cost structure identifies the key expenses and capital in-vestments related to producing and delivering the offering.

ILLUSTRATIVE EXAMPLE

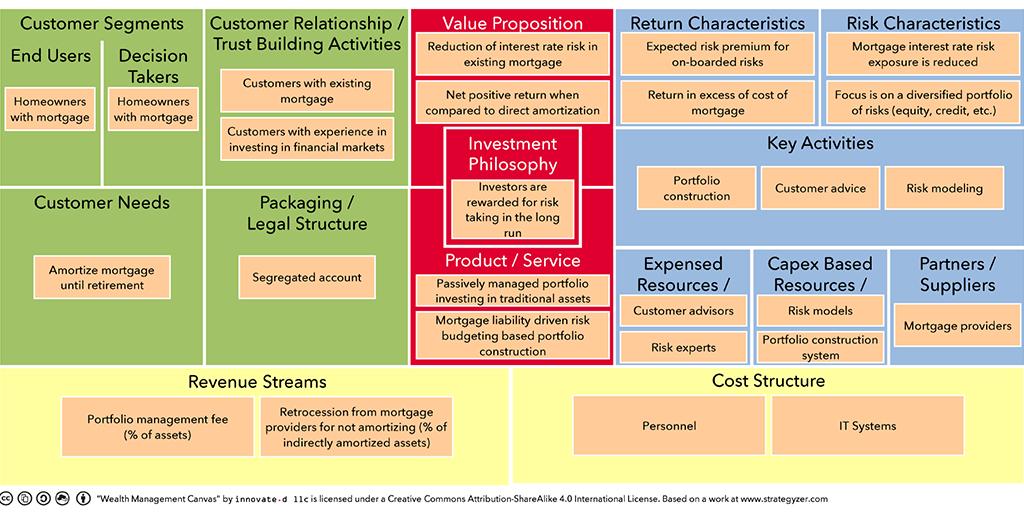

The wealth management canvas may at first look somewhat abstract. To illustrate its power, consider the example shown in Exhibit 2.

CUSTOMER COMPONENT

Consider as customer segment, homeowners with a mortgage that they want to amortize over time (the customer need). In this example, the end-user is also the decision-taker. The customer relationship is directly attached to the mortgage relationship. To ensure trust and avoid bad press due to misunderstanding of the offering, only customers with investment experience are targeted.

OFFERING COMPONENT

Rather than amortize the mortgage directly through monthly installments, the offering allows to invest the monthly installments into a segregated account which is managed such as to

- reduce the interest risk exposure of the indirectly amortized part of the mortgage, and

- generate a net positive return in excess of the interest rate costs of the indirectly amortized part of the mortgage.

The investment is managed in a segregated account based on the investment philosophy that, in the long run, onboarding financial risks is rewarded. The main focus is on diversifying and managing the portfolio risk, considering the interest risk of the mortgage liability.

PRODUCTION COMPONENT

The portfolio return is derived from the onboarded risks in such a way as to cover the interest rate costs of the indirectly amortized part of the mortgage. In addition, risk is diversified over multiple non-interest rate risk categories.

Key activities are

- ensuring that the customer understands the offerings, its implications and underlying risks, and

- construction and management of the portfolio based on the interest rate risks inherent to the mortgage and expected risk premium.

Investments are driven by automating the portfolio construction and management activities using technology.

Key partners are mortgage providers.

FINANCIAL COMPONENT

The business model is built on top of two complementary revenue streams, that is,

- a portfolio management fee, as percentage of the value of the assets in the portfolio, and

- a retrocession from the mortgage provider based on the size of the indirectly amortized part of the mortgage.

Main cost drivers are personnel and investments in technology.

LESSONS LEARNED

Developing successful wealth management solutions requires more than formulating a sound investment case.

- Successful wealth management solutions focus on identifying targeted customer segments and satisfying their specific needs.

- The value proposition should be based on a sound investment philosophy and relate to the customers’ needs through a trusted relationship.

- Delivering on the promises made requires focusing on both return and risk.

The wealth management canvas provides a holistic framework for designing, discussing, testing, and documenting wealth management solutions.