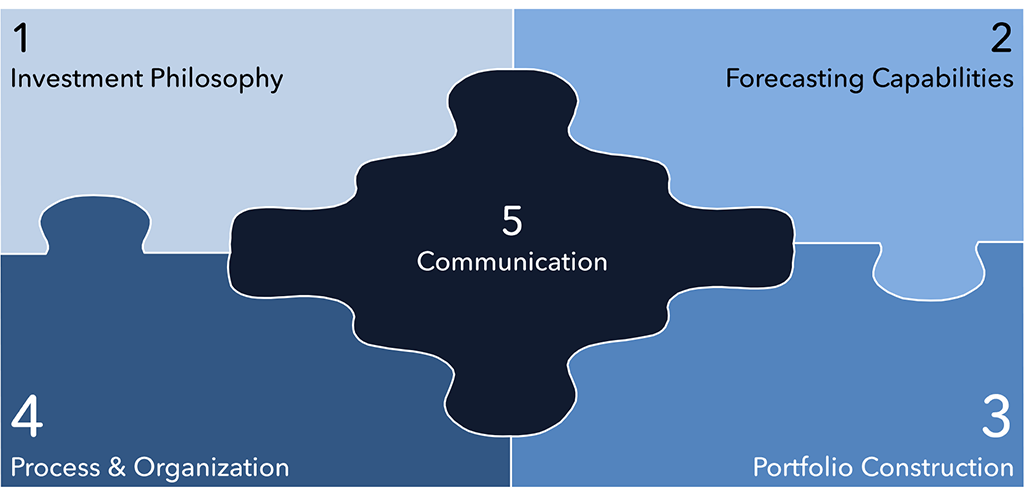

Systematically achieving set investment goals require a sound investment process. Any investment process should be composed of five puzzle pieces put together by skilled people. First the foundation, that is, the investment philosophy must be defined. Forecasting capabilities both along the return and the risk dimension are the second required puzzle piece. Portfolio construction ensures that the forecasting capabilities are translated into investment performance with minimal frictions. As a fourth puzzle piece, a sound process executed by a well-defined organization is key to success. Finally, at the center of the puzzle should be the communication piece which ensures maintaining the trust of the investor through informing about delivering upon the promises made.

No investment process should be designed without first defining an investment goal. The investment goal describes the promises made to the investor. It is, in most cases, specified along the tree dimensions

- expected return,

- risk characteristics, and

- time horizon.

To deliver upon a formulated investment goal, a sound investment process should be composed of five key components, called its puzzle pieces, as shown in Exhibit 1. As with a real puzzles, any specific piece has its place. But it is only their correct arrangement that leads to the overall picture, and therefore success.

PIECE 1: INVESTMENT PHILOSOPHY

The investment philosophy describes the fundamental beliefs on which the investment process is based. It provides a shape to the investment decisions take. In many cases the investment philosophy rests on empirical observations combined with judgmental causality assumptions.

Possible investment philosophies found in typical equity investment processes are:

- Fundamental investing – Investing in companies that exhibit above average earnings expectations.

- Value investing – Investing in relatively undervalued stocks and expecting their price to revert to the fair value over time.

- Growth investing – Investing in companies that exhibit a promising product or service portfolio with significant growth potential.

- Socially responsible investing – Investing in companies that adhere to certain set of moral and/or ethical business standards assuming they will generate an above average risk adjusted return.

- Technical investing – Based on past market data, investing in securities that show visual patterns in trading activity.

- Contrarian investing – Investing in securities in direct opposition to the majority of the market participants, e.g., buying when the majority is selling.

A successful investment philosophy is characterized by a comprehensible belief, ideally supported by data, combined with forecasting skills based thereon. In addition, it is critical to know what the assumptions behind a chosen investment philosophy are.

PIECE 2: FORECASTING CAPABILITIES

The second puzzle piece is called forecasting capabilities. It should be subdivided into return and risk forecasting capabilities and aligned with the investment philosophy.

RETURN FORECASTING CAPABILITIES

The return forecasting capabilities should describe

- what is forecasted, that is, the structure of any forecast, and

- how forecasts are formulated, that is, which capabilities are required, and by which process these capabilities are exploited.

Return forecasts are called investment decisions. Their structure is often one-dimensional, and they can be formulated either by human experts, by quantitative models, or a combination thereof. Possible return forecasting capabilities could be

- forecasting the relative preference between two regional equity markets (the “what”), like forecasting that U.S. equities will outperform Japanese equities over the next quarter, and

- basing the forecast on current consensus GDP forecasts as reported by Bloomberg for the considered markets (the “how”).

RISK FORECASTING CAPABILITIES

In a successfully investment process, risk is also considered a forecast at the same level as return. As with return forecasting capabilities, risk forecasting can be decomposed in a “what” part and a “how” part.

- The “what” part is often defined by a quantitative model based on assumptions, like using a co-variance matrix.

- The “how” part relates to the approach chosen for estimating the parameters of the model. For example, in the co-variance matrix case, a shrinkage estimator using five years of weekly historical return data, could be used.

The risk forecasting capabilities should be chosen with respect to the role of the risk characteristics toward achieving the formulated investment goal. Risk forecasts generally exhibit a multi-dimensional structure and are therefore best formulated using quantitative models.

PIECE 3: PORTFOLIO CONSTRUCTION

The portfolio construction puzzle piece describes how the forecasting capabilities are translated into transactions and portfolio positions. Key in successful portfolio construction is minimizing the loss of information, and thereof investment performance, when translating forecasts, conditioned on the investment goal, into portfolio holdings.

Portfolio construction is in many cases defined by a given utility function, for example, maximizing the probability to achieve a positive return, and a set of constraints. Some of the most common portfolio construction models considering both the risk and return dimensions over a single time period are:

- Markowitz – Maximize the expected return for a given portfolio volatility.

- Black-Litterman – Construct a portfolio that deviates from a market weighted portfolio by weights determined using Bayesian statistics theory based on individual investment decisions.

- Optimal risk budgeting – Allocate risk budgets to individual investment decisions based on investor’s confidence and transfer those decisions into portfolio positions.

PIECE 4: PROCESS AND ORGANIZATION

The process and organization puzzle piece describes the steps to be followed to deliver upon the investment goal set. A clear, concise, and repeatable process description is required. Experience has shown that simply following a systematic process can significantly increase the investment performance compared to an ad-hoc approach. But a process alone is not sufficient. Roles and responsibilities for performing the designed process must be defined through an organization structure.

A sound process distinguishes between information gathering, information processing, decision taking, and executing upon decisions taken. Accountability at each stage is key.

PIECE 5: COMMUNICATION

Often getting only shabby treatment, but not less important, is the communication puzzle piece. Communication is required to deliver the outcome of the investment process to the investor. Successful communication requires answering the five W questions:

- What – Which forecasts were formulated, what portfolio transactions resulted out of them, and what impact did they have on achieving the investment goal along the dimensions return and risk?

- When – At what point in time where the forecasts made and what was the time horizon in mind?

- Why – What were the rationales, derived from the capabilities, which lead to the forecasts made?

- Where – How were the forecasts translated into portfolio positions?

- Who – Who was involved and who was responsible for the forecasts formulated and their transfer into portfolio positions?

A successfully communication approach focuses on supporting the investment process at each of its stages. It also aims at building and maintaining trust and be tailored to the needs of the individual stakeholders.

GLUE. PEOPLE

You may wonder why I did not consider people as a key puzzle piece. The reason is simple. People design the individual puzzle pieces and fill them with life. But they are not needed by themselves. People add value through their skills, experience, and resources to any of the five puzzle pieces but cannot replace any of them.